标题:iSuppli公司看好2006年存储市场

iSuppli公司预测,2006年NAND闪存的销售增长会比人们预期的要慢很多,但DRAM市场却将显示出令人吃惊的爆发力,使得整个存储器市场比2005年要增长将近13%。DRAM和NAND是半导体存储器市场最大的两个组成部门,2006年这两大产业的销售收入将达到4020亿美金,比2005年的3560亿美金高出12.9个百分点。以NAND市场来看,iSuppli的乐观态度建立在这样一个事实基础之上:NAND器件的平均售价在2005年降低了55%,而NAND产业在2005年产生了370亿美金的经营性利润,供应商由此获得了35%的利润率。

Memory Barometer

iSuppli’s 2006 Memory Outlook Remains Optimistic

Combined NAND/DRAM revenues to rise 12.9 percent in 2006

By Nam Hyung Kim

Although NAND flash memory sales will rise more slowly than expected in 2006, the DRAM market will show surprising strength, causing the combined segments to expand by nearly 13 percent for the year, iSuppli Corp. predicts.

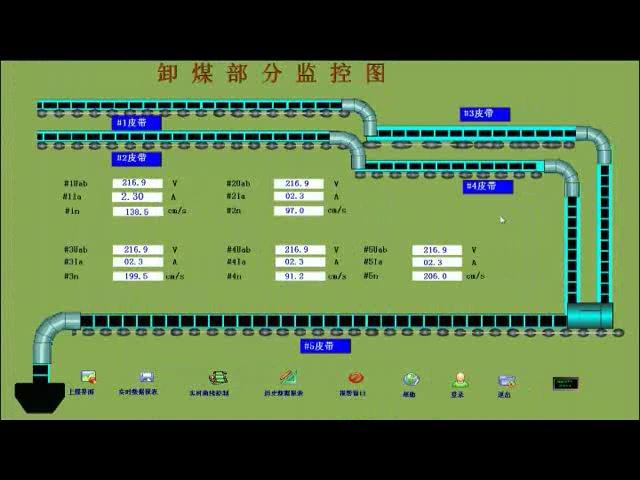

DRAM and NAND, which represent the two largest segments of the semiconductor memory market, together are expected to achieve revenue of $40.2 billion in 2006, up 12.9 percent from $35.6 billion in 2005. This compares to 7.5 percent growth in 2005. Figure 1 presents iSuppli’s forecast of combined NAND and DRAM revenue.

Reflecting recent market developments, iSuppli has trimmed its NAND flash market revenue forecast to $13.8 billion this year, down from our previous prediction of $16 billion. While growth will fall short of iSuppli’s previous forecast of a 49 percent expansion, the global NAND market still will rise by 28 percent in 2006, up from $10.7 billion in 2005, making this component one of the fastest-growing segments of the global semiconductor market this year.

Recent price declines have spurred pessimism regarding NAND flash pricing and revenue growth in 2006. Despite this, iSuppli remains optimistic about worldwide NAND market growth this year—and about conditions for suppliers.

The main reason iSuppli is maintaining a positive view is that growth in the NAND flash market is not driven by trends in pricing, but rather by the explosive expansion in unit shipments. For example, Average Selling Prices (ASPs) for NAND parts declined by about 55 percent in 2005—yet the NAND industry as a whole generated an estimated $3.7 billion in operating profits last year, representing an operating margin of 35 percent for suppliers.

That’s a whole lot of profitability.

iSuppli expects another 55 percent ASP decline this year, making it likely that suppliers will be profitable once again in 2006. However, operating margins will decline as competition intensifies.

Furthermore, growth in unit shipments will continue at a blistering pace this year. Although iSuppli has cut its forecast for 2006 NAND flash unit growth to 187 percent, down from 207 percent previously, this explosive expansion in shipments will drive the market’s rise once again this year.

The first-quarter NAND slowdown had been expected, due to the highly-seasonal nature of demand from the consumer-electronics market. Despite this, the rate of price decreases has been more severe than anticipated, mainly due to developments in the MP3 player market.

U.S. retailers in mid December held virtually zero inventory of Apple Computer Inc.’s wildly-popular iPod nano player, due to soaring sales during the holiday season. However, with holiday demand having ended, retailers have built up significant stockpiles of the NAND-based iPod nano. This has caused Apple’s shipments to slow and its demand for NAND flash to fall short of expectations in the first quarter.

Moreover, many makers of MP3 players have built up their NAND inventories during the fourth quarter, anticipating tight supplies of the part at the start of the year. But, NAND supply increased at a faster-than-expected rate in the first quarter. These factors have resulted in lower-than-expected demand for NAND.

In contrast to the NAND market, DRAM is enjoying price increases in early 2006, confirming iSuppli’s prediction (see DRAM Prices Set to Rebound During the First Quarter, iSuppli Market Watch, Dec. 12, 2005). Unfortunately, the price rally fizzled this month, which will make it difficult for suppliers to raise prices in April.

However, reflecting improved business conditions, iSuppli has raised its forecast of DRAM sales so that revenue now is expected to rise for the year.

Worldwide DRAM revenue is expected to rise to $26.4 billion in 2006, up 6.2 percent from $24.8 billion in 2005. iSuppli previously expected a 5 percent contraction in DRAM revenue for the year.

The recently-announced delay in Microsoft Corp.’s Vista will not impact iSuppli’s 2006 DRAM forecast, given that we previously had predicted the new operating system would arrive at the end of the fourth quarter, and thus would not have much influence on the memory market until 2007.

Nam Hyung Kim is a principal analyst with iSuppli Corp. Contact him at nkim@isuppli.com

评论